can you cash in a pension

It may also affect any means-tested benefits you might receive. You can only apply for pension drawdown online were unable to process applications over the phone.

How Do I Cash In My Small Pension Low Incomes Tax Reform Group

HUGE state pension errors that led to one woman missing out on a whopping 128000 of payments have been branded a shameful shambles.

. The amount of tax you pay on income from the plan will depend on your circumstances and may change based on your income tax rate. Youve already saved 1073100 in pension schemes over your lifetime your lifetime allowance you have some type of lifetime. The sum you need is substantial so you start looking around for ways to raise cash.

I want control over my pension. Hundreds of thousands of Brits were not paid the state. You cant take smaller cash sums if any of the following apply.

Penalty for Cash Out Pension Plan Early. Income above your personal allowance is taxable. We can only accept transfers of your full pension pot.

While you may have the ability to access some of your investments such as a 401 k this isn t possible for the fund s in your CalPERS pension accountThere is only one instance where you can access your CalPERS pension contributions when you leave CalPERS employment. Im happy to apply for pension drawdown online. PENSION cash is vital for Britons in retirement but many are unaware of an important rule change which could impact their access to savings.

Its worth remembering that you can run out of money if you take too much or if you live longer than expected. 2004 Fri Jan 7 2022 UPDATED. The best way to avoid any penalty when you cash out your pension early is to roll your money into an IRA when you leave the company.

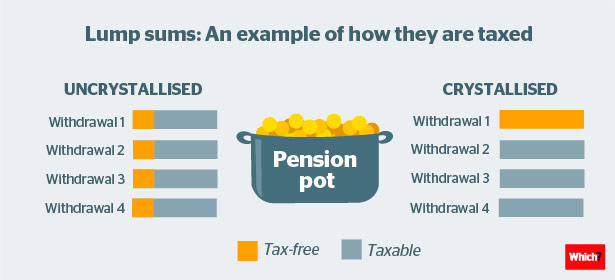

You run across an online ad that offers a lump-sum advance on your pension payments. You could close your pension pot and take the whole amount as cash in one go if you wish this is called a lump sum. Or you could treat your pension pot like a bank account and make several withdrawals when you need to.

We cant accept pensions that are already in drawdown so you must not have accessed the tax-free cash from your pension yet. You decide how much to take and when to take it you can even take the full value of your pension plan in one go. At the beginning of retirement in 2023 their DB pension income wont be enough to cover their cash-flow needs Mr.

Want to take cash from your pension plan. So can you cash out a pension early. Your income is taxable.

The Pension Annuity cant be cashed in or surrendered. But first lets talk about the penalty when you cash out your pension early. If you receive a lump sum distribution prior to reaching age 55.

You can usually start taking lump sums from your pension plan once you reach age 55 subject to change. You may get back less than.

Can I Put My Pension Fund In Cash For My Retirement This Is Money

Can I Cash In A Pension From An Old Employer

Can I Cash In A Pension From An Old Employer January 2022

Can I Cash In My Pension From An Old Employer 10000s Cash

Can I Cash In A Pension From An Old Employer January 2022

Should I Take A Lump Sum From My Pension Which

Expat In The City Pensions In Germany What You Need To Know And Do To Benefit

0 Response to "can you cash in a pension"

Post a Comment